Deep Dive: How Search Funds Lose Deals

Key Takeaways

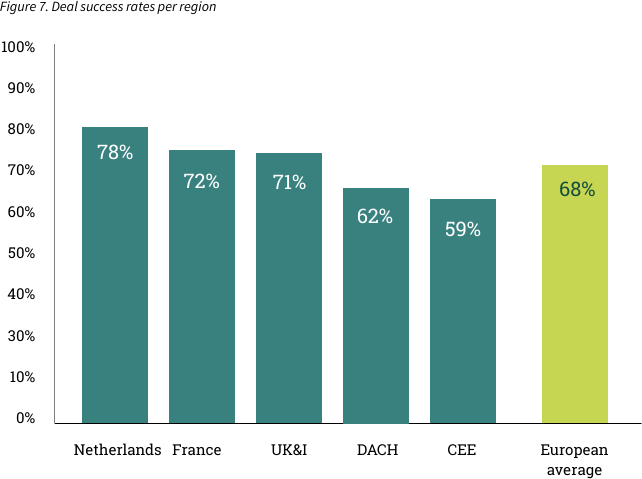

~68% of European mid-market sell-side mandates result in a successful close, meaning roughly 1 in 3 deals collapse before completion.

The Netherlands closes ~78%, while Central & Eastern Europe sit closer to

~59%, showing execution quality, not just price, determines outcomes.

Many search funds donʼt lose on valuation. They lose because another buyer demonstrates faster communication, clearer positioning, and stronger certainty of closure.

When a European searcher imagines losing a deal, they often picture being outbid at the last minute. In practice, thatʼs rarely how it happens. Most deals donʼt die because of a dramatic bidding war. They die slowly, through delays, fuzzy answers, and small trust breaks that accumulate until the seller quietly backs away.

Across the European mid-market, the numbers show how fragile processes are. Recent monitoring of sell-side mandates suggests that only around 68% of assignments actually make it to a closed deal, with the rest being withdrawn or failing to find a buyer. In some markets, like the Netherlands, completion rates push close to 80%. In others, like parts of Central & Eastern Europe, they sit closer to 60%.

Search funds typically lose deals in three predictable phases:

Not Making the Shortlist

The first cut happens early. Advisers decide who looks credible, bankable, and focused.

Searchers fall off the shortlist when they:

Describe their target as “any good business.ˮ

Lack a clear sector or country focus

Ask generic questions

Canʼt explain financing clearly

In a competitive environment with private equity and cross-border buyers, generalists rarely advance. Specialists do.

LOI to Signing

Many searchers believe the deal is “wonˮ once an LOI is signed. Sellers view that moment as the beginning of the test.

Deals stall when buyers:

Respond slowly during diligence

Retrade or shift valuation logic

Provide vague lender updates

Let weeks pass without structured communication At this stage, hesitation looks like risk.

Losing Trust

The final kill point is emotional. Numbers still work, the bank is supportive, but the seller no longer sees the buyer as the right successor.

Trust breaks when the buyer:

Talks about fixing the company before understanding it

Focuses only on structure and upside

Minimises legacy, role clarity, or transition

Most European SMEs that are attractive to search funds are long-term projects: twenty, thirty, sometimes forty years in the hands of one owner. The sale is a once-in-a-lifetime event. If a buyer looks purely transactional, the seller will compare them to any other option that feels more human – even if that other option is slower or slightly cheaper.

Search is a numbers game at the top of the funnel. But at the deal level, itʼs a confidence game.

The model tells you what a business is worth.

Your process and how you show up decide whether you ever get to own it.

Insight of the Week

The UKʼs injection moulding market shows how much roll-up potential can hide in a single “boringˮ niche. According to estimates, there are roughly 1,500 moulders in the UK, with about 40% owned by founders nearing retirement, creating 400– 500 plausible targets in one sector alone. Combine that with excess machine capacity, limited automation, and almost no succession planning, and you get a landscape where a disciplined operator can methodically acquire companies without external capital by narrowing their focus, avoiding founder-reliant or generalist firms, and targeting recurring, durable revenue streams.

Deal Watch

Launched

Vitis Capital - IT

Italy-based Vitis Capital, founded by Francesco Contento and Daniele Zagnoni, is a traditional search fund focused on acquiring and operating a single high-potential Italian SME. Vitis is targeting companies with €10–50M revenue, EBITDA above 10%, and recurring revenues in resilient, low-to-medium capital intensity sectors with consolidation potential. The ideal seller is a family or founder-owner ready to transition but keen to preserve culture, people, and long-term continuity, with a majority stake (>70%) transferring and the owner supporting a smooth handover.

Transactions

Star First Partners - IT

Star First Partners, the Italian search fund launched by Alessandro Conti in 2023, has acquired Olistika, a leading super-premium pet food company headquartered in San Marino and active across Italy. The company has delivered over 15% CAGR from 2021-2024 and now reaches more than 1,000 points of sale nationwide.

Kaeron - BE

Belgium-based Kaeron, the search fund launched by Frédéric Schilling, has completed the acquisition of Groupe Jordan, a leading HVAC player in Hainaut. Groupe Jordan employs more than 110 professionals, generating around €20M in turnover and approximately €1.5M in EBITDA. Schilling positions Groupe Jordan as the platform for a broader Benelux and France buy-and-build strategy in energy-transition-focused HVAC.

For the Commute

Emotion, Succession, and Search Funds with Henrik Buehler (Aulium Podcast)

Henrik Buehler shares why he believes M&A, like most B2B and consumer

decisions, is fundamentally emotional and how that shapes seller behavior in succession deals. He walks through his journey from investment banking and

private equity into launching H&B Mittelstandspartner, a traditional search fund focused on acquiring and operating a single SME in Europe. He explains the mechanics of traditional versus self-funded search funds, and outlines what makes a “greatˮ SMB target in Europe. The conversation digs into cofounder dynamics, investor ecosystems, and practical sourcing tactics for searchers who want to be long-term operators.

👉 Was this email forwarded to you? Subscribe here to get ETA Europe delivered to your inbox every Thursday 👈